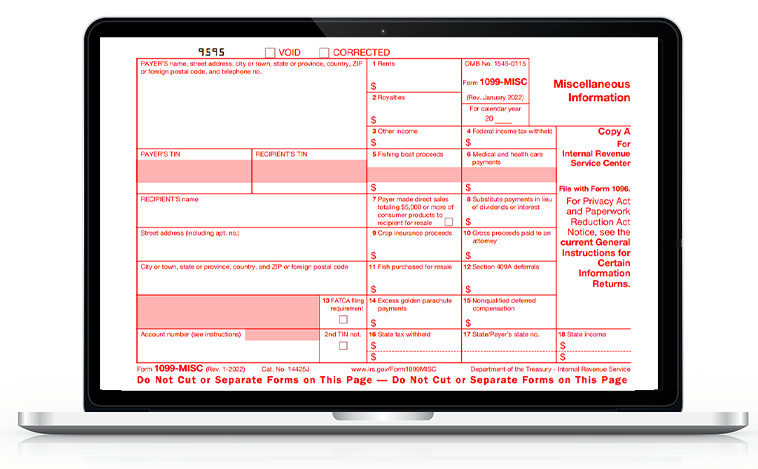

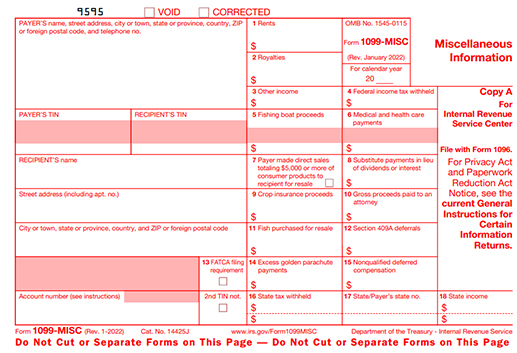

What is IRS 1099 MISC Form?

If you paid any sort of Miscellaneous income other than employees’ wages, you need to report the income & taxes withheld to the IRS through Form 1099 MISC. This form is used to report payments for rent, fishing boat proceeds, medical and health care payments, prizes, awards and more. Also, you need to send copies of the 1099 form to the recipients.

Click Here to Know more about 1099 MISC changes for 2022

Who needs to file IRS 1099-MISC Form?

Conditions to File IRS 1099-MISC Form:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- If paid a minimum of $600 in Rents, Prizes and awards, Other income payments, Medical and health care payments, Payments to an attorney, Crop insurance proceeds, Cash paid from a notional principal contract to an individual, partnership, or estate, Any fishing boat proceeds, Section 409A deferrals, Nonqualified deferred compensation

- In addition, use the 1099-MISC Form to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

- Even if the payment is less than $600 and withheld any federal income tax under a backup withholding, you must report all of that payment through Form 1099-MISC.

Visit https://www.taxbandits.com/1099-forms/form-1099-misc-vs-nec-information/ to know more about the Form 1099 NEC vs 1099 MISC.

IRS 1099 MISC Form Deadlines for 2022 Tax Year

Recipient Copy Deadline:

January 31, 2023

Paper Filing Deadline:

To report other payments made

February 28, 2023

E-filing Deadline:

March 31, 2023

Visit https://www.taxbandits.com/1099-forms/form-1099-misc-due-date/ to know more about 1099 MISC deadline.

Also find the 2023 IRS Filing Deadlines for 1099 here

Fill out and submit your W-9 online.

Fill out Form W-9 electronically securely through TaxBandits. Users must enter the necessary information, such as their name, residence, TIN, and Federal Tax Classification. They can then check and update the information before downloading or sharing the form using TaxBandits. The form can either be sent to payers or printed and distributed.

State Filings for 1099 Forms

Your 1099-MISC Filing doesn't end with the Federal Filings alone. You need to report to the respective state agencies as well. Currently our e-filing software helps out 1099 filing for the states which participate in the Combined Federal and State Filing Program (CF/SF).

Learn more about Form 1099 State Filing requirements.

Other Supported Forms

- Form 1099-NEC, Form 1099-K, INT, DIV, R, S, G, C, B, PATR & other 1099 Form

- Form 1095-B/C, 941-PR, 941-SS

- Form W2, W-2c, W-2PR, W-3

- Form 941, 941-PR, 941-SS

- Form 990-N, 990-EZ, 990, 990-PF & 1120-POL

- Form 8868, Form 8809

Penalties For Late Filing a IRS 1099 MISC Form

It is important to file Form 1099-MISC on time to avoid late filing penalties. If you are beyond the deadline, & cannot show a reasonable cause, you may be subjected to penalties.

You might face penalties on the following criterias:

- Fail to file on time,

- If you file on paper when you were required to file electronically.

- Fail to include all information required to be shown on a return, or you include incorrect information on a return.

- Report an incorrect TIN or failed to report a TIN.

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

Request W-9 NowContact Us We are always happy to help!

(704)-684-4751

We are here to support you directly from

SPAN Enterprises LLC,2685 Celanese Road, Suite 100,

Rock Hill, SC 29732.