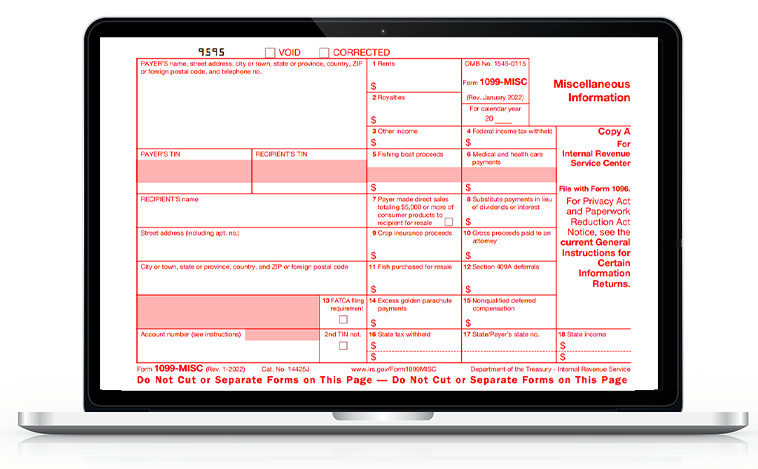

Checkout the information from the following table to know what the each box in Form 1099-MISC represents.

| Box | Description |

|---|---|

| Box 1.Rents | Report payment of $600 paid as rent. |

| Box 2. Royalties | If your business paid gross royalties of $10 or more to the recipient, you might have paid a royalty for use of a patent, copyright, trade name or trademark. |

| Box 3. Other Income | If you paid the recipient minimum $600 for something that isn’t covered by one of the other boxes on form 1099-MISC, report it here. including prizes and awards. |

| Box 4. Federal Income Tax Withheld | If the recipient was subject to backup withholding, report the amount your business withheld from their pay in this box. |

| Box 5. Fishing Boat Proceeds | Use it if your business paid someone for catching fish. The share of all proceeds from the sale of a catch or the fair market value of a distribution to each crew member of fishing boats with less than 10 crew members. |

| Box 6. Medical and Health Care Payments | If your business paid $600 or more to medical or health care service providers will be report on Box 6. This is only for payments made in the conduct of business (not things like personal visits). It also includes payments made for insurers under accident, sickness, and health insurance programs. |

| Box 7. Direct sales totaling $5,000 or more made to a recipient for the resale of consumer products | Check this box if you sold a consumer product for a total value of $5000 or more for resale or buy-sell. |

| Box 8. Substitute Payments in Lieu of Dividends or Interest | Aggregate payments of at least $10 received by a broker for a customer in lieu of dividends or tax-exempt interest as a result of a loan of a customer's securities. |

| Box 9. Crop Insurance Proceeds | Crop insurance proceeds of $600 or more paid to farmers by insurance companies. |

| Box 10. Gross Proceeds Paid to an Attorney | Report the total amount of $600 or more paid to an attorney for legal services. |

| Box 11. Fish Purchased for Resale | Report Payment for Fish Purchased for Resale in this box |

| Box 12. Section 409A Deferrals | Completing this box is optional; if you contributed to a section 409A retirement plan but weren’t an employee. |

| Box 13. Excess Golden Parachute Payments | Report excess golden parachute payments subject to a 20% excise tax. |

| Box 14. Nonqualified deferred compensation | Report payments under an NQDC plan that do not meet the requirements of section 409A. Any payment reported in box 12 is currently taxable and is also included in this box. |

| Box 15 to Box 17 | Report state or local income tax withheld from the payments |

What are the Copies in Form 1099-MISC?

The 1099-MISC is a multi-part form. Here are the parts of this form and where to send each:

- Copy A is sent to the Internal Revenue Service.

- Copy B is for the recipient.

- Copy C is for the payee.

- Copy 1 is sent to the state tax department(s).

- Copy 2 is for the recipient to file with his/her state income tax return.

Note: Copies B and 2 must be received by the person no later than January 31 of the year after the tax year.

Don’t worry about the copies when you are here. You just get started with our efile software and we will print and mail the required copies to your recipients on time.

Contact Us We are always happy to help!

Mail us at: support@taxbandits.com

Call us at: (704)-684-4751

We are here to support you directly from

SPAN Enterprises LLC,2685 Celanese Road, Suite 100,

Rock Hill, SC 29732.